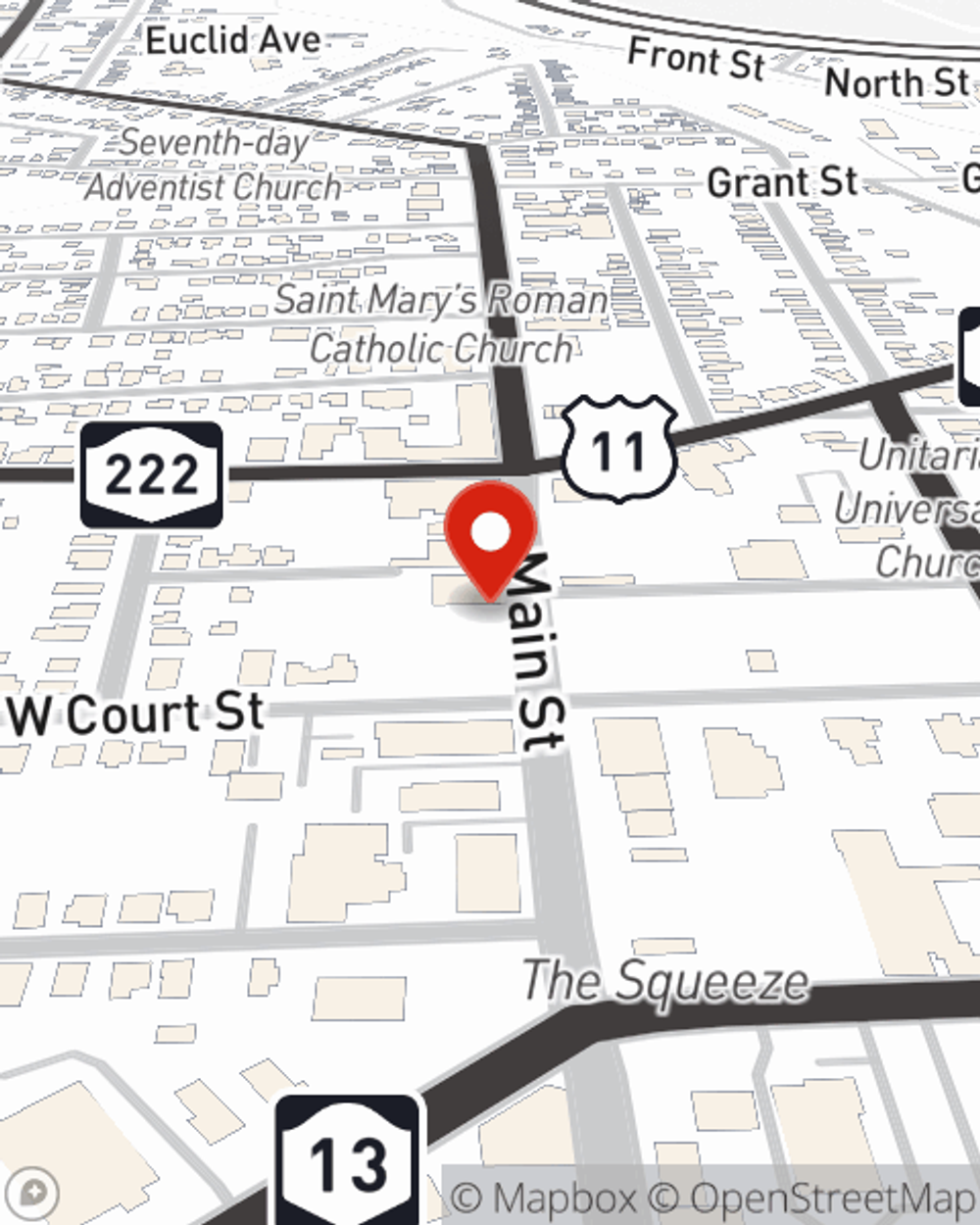

Life Insurance in and around Cortland

Coverage for your loved ones' sake

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

Be There For Your Loved Ones

If you are young and just starting out in life, it's the perfect time to talk with State Farm Agent Al Myers about life insurance. That's because once you start building a life, you'll want to be ready if tragedy strikes.

Coverage for your loved ones' sake

Don't delay your search for Life insurance

Wondering If You're Too Young For Life Insurance?

Coverage from State Farm helps you rest easy knowing your loved ones will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the high costs of providing for children, life insurance is critically important for young families. Even if you don't work outside the home, the costs of filling the void of daycare or domestic responsibilities can be substantial. For those who don't have children, you may be financially responsible to business partners or have debt that your partner will have to pay.

Did you know that there's now a life insurance option available that's perfect for anyone who thought they couldn't qualify? It's called Guaranteed Issue Final Expense and it can really prove useful when it comes to supplement the financial options for final expenses like medical bills or funeral costs. Don't let these expenses weigh down your loved ones in the future - check out State Farm Guaranteed Issue Final expense from State Farm agent Al Myers and see how you can be there for your loved ones—no matter what

Have More Questions About Life Insurance?

Call Al at (607) 756-9969 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.

Simple Insights®

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

What happens when term life insurance expires?

What happens when term life insurance expires?

Understand your options before your level term life insurance policy becomes annually renewable causing your premiums to increase.